Content

- Activities specifically excluded from trade or business

- Inflation Reduction Act includes 15% corporate minimum tax on book income

- Dissecting Section 1202’s “Active Business” and “Qualified Trade or Business” Qualification Requirements

- QBI Deduction – Specified Service Trade or Business (SSTB)

- Exploring the undefined: Trade or business

- Assessing Whether the Principal Asset of a Business Is the Reputation or Skill of One or More of Its Employees.

The exercise is not intended to provide a comprehensive analysis of every business activity that falls within the scope of Section 1202. For the purposes of this paragraph, the term “tax regime” means a set or system of rules, laws, regulations, or practices by which taxes are imposed on any person, corporation, or entity, or on any income, property, incident, indicia, or activity pursuant to governmental authority.

- ‘ In general.–Except as provided in subparagraph , the amendments made by this subsection shall apply to amounts paid or incurred after September 13, 1995, in taxable years ending after such date.

- The preceding sentence shall not apply to any Federal employee during any period for which such employee is certified by the Attorney General as traveling on behalf of the United States in temporary duty status to investigate or prosecute, or provide support services for the investigation or prosecution of, a Federal crime.

- “ ‘Payroll period’ means a payroll period as defined in section 3401 of the Internal Revenue Code of 1986.

- Please remove any contact information or personal data from your feedback.

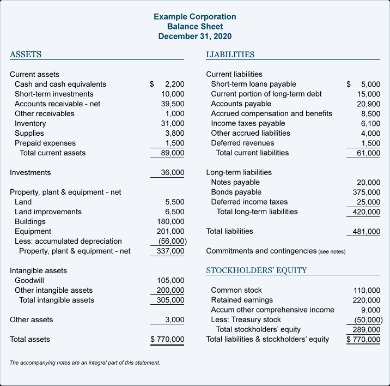

Please remove any contact information or personal data from your feedback. An in-depth look at tax and accounting issues with deferred revenue. The Tax Adviser is the AICPA’s monthly journal of tax planning, trends, and techniques. ” the conducting of such game of chance by organizations which were not nonprofit organizations would have violated such law. 101–508 inserted before period at end “, by substituting ‘calendar year 1987’ for ‘calendar year 1989’ in subparagraph thereof”.

Activities specifically excluded from trade or business

The Trade Or Business products on (the “Site”) are underwritten by different carriers dependent on the relevant line of business – see huckleberry.com/carriers. Treatment of computer software that produces active business computer software royalties for purposes of satisfying the 80% Test. As mentioned above, a significant aspect of our Section 1202 work involves analyzing whether business activities fall within the scope of Section 1202. This work involves looking at details facts about the business activities and considering them in the context of the limited Section 1202 tax authorities and other sources that are useful for defining the scope of the activities listed in Section 1202.

” Effective Date.-Subsection shall apply to games of chance conducted after June 30, 1981, in taxable years ending after such date.” “ as if the individual were an employee of an organization not described in section 170 of such Code. Substituted “reacquisition” for “redemption” in the subsection heading.

Inflation Reduction Act includes 15% corporate minimum tax on book income

https://intuit-payroll.org/ business income does not include royalty income from licensees of patents owned by a university that were assigned to it by inventors for specific percentages of future royalties. Gambling winnings, except winnings from horse and dog racing, are generally subject to withholding under G.L. 62B, § 2, regardless of whether the wagering activities of the taxpayer constitute a trade or business. Massachusetts gross income is federal gross income, with certain modifications not relevant here.

Can investing be a trade or business?

Investors typically buy and sell securities and expect income from dividends, interest, or capital appreciation. They buy and sell these securities and hold them for personal investment; they're not conducting a trade or business.

“Compensation” means wages, salaries, commissions, and any other form of remuneration paid to an employee for personal services. The department may issue guidance as to what expenses reduce active trade or business income. The first year that a taxpayer may make the subtraction under subsection 2 of this section is 2017, provided that the provisions of subsection 5 of this section are met.

Dissecting Section 1202’s “Active Business” and “Qualified Trade or Business” Qualification Requirements

Sec. 1.199A-1 provides that a trade or business means “a trade or business that is a trade or business under section 162 other than the trade or business of performing services as an employee.” Sec. 162 does not provide an explicit definition of what constitutes a trade or business. The preamble to the final Sec. 199A regulations states that the IRS and Treasury declined to establish a bright-line test for determining a trade or business for purposes of Sec. 199A because that specific guidance is beyond the scope of the Sec. 199A regulations. However, the preamble discusses two relevant considerations for taxpayers, derived from case law addressing trades or businesses under Sec. 162. First, a taxpayer must enter into and carry on the activity at issue with a good-faith intention to earn a profit. Second, the taxpayer must engage in the activity on a regular and continuous basis (see Groetzinger, 480 U.S. 23 ). One situation where the “substantially all” standard could be useful is where a corporation that had a majority-owned stock position in a subsidiary sold enough stock or caused the subsidiary to issue enough stock to cause ownership to fall below the 50%+ ownership level required by Section 1202 to avoid characterization of the subsidiary’s stock as investment portfolio stock.

- In the case of any publicly held corporation, no deduction shall be allowed under this chapter for applicable employee remuneration with respect to any covered employee to the extent that the amount of such remuneration for the taxable year with respect to such employee exceeds $1,000,000.

- The conduct of such trade or business is not substantially related to the organization’s performance of its exempt functions.

- A person to or from whom there is attribution of stock ownership in accordance with section 1563 of the Internal Revenue Code of 1986.

- For temporary amendment of this section, see §§ 14 and 15 of the Fiscal Year 2016 Budget Support Clarification Temporary Amendment Act of 2015 (D.C. Law 21-76, Feb. 27, 2016, 63 DCR 264).

- Any amount paid by a taxpayer for insurance to which paragraph applies shall not be taken into account in computing the amount allowable to the taxpayer as a deduction under section 213.

- “ Any company, a substantial part of the business of which consists of receiving deposits and making loans and discounts or of exercising fiduciary powers similar to those permitted to national banks under authority of the Comptroller of the Currency, which is organized or created under the laws of a foreign country and which maintains an office or branch in the District.

- It’s important to note interest income, some dividends, and capital gains are not included in the IRS’s definition of “income,” which is limited to only items included in taxable income.

Paragraph shall not apply to any amount paid or incurred by reason of any order of a court in a suit in which no government or governmental entity is a party. In the case of any amount of restitution for failure to pay any tax imposed under this title in the same manner as if such amount were such tax, would have been allowed as a deduction under this chapter if it had been timely paid. Private Letter Rulings are IRS ruling based on specific taxpayer facts, do not bind the IRS with respect to other taxpayers, and cannot generally be relied upon or cited by other taxpayers as authority. However, Section 6662’s regulations do state that PLRs can be considered tax authorities in connection with the determination of whether there is “substantial authority” for a taxpayer’s return position, although they carry little weight in such determination. There are two IRS Private Letter Rulings addressing health services related activities in the context of Section 1202 that provide some useful guidance.